Top 10 diabetes drugs worth watching in 2024

Abstract

The diabetes pharmaceutical space continues to grow due to advances in drug development, increasing diabetes prevalence, and a growing need for innovative therapies. Diabetes affects millions of people worldwide, and major pharmaceutical companies are launching treatment options that not only improve glycemic control but also address cardiovascular and kidney-related complications, providing patients with comprehensive diabetes disease management.

| Number | Name | Company | Indications | Types of medication | Sales in 2023(billion) |

| 1 | Ozempic (Semaglutide) | Novo Nordisk | Type 2 diabetes, cardiovascular risk | Peptides | $138.92 |

| 2 | Jardiance (Empagliflozin) | Boehringer Ingelheim/Eli Lilly | Type 2 diabetes, chronic heart failure, chronic kidney disease | Chemicals | $107.3 |

| 3 | Trulicity (Dulaglutide) | Eli Lilly | Type 2 diabetes | Antibody Fusion Protein | $71.32 |

| 4 | Insulin (Various Forms) | Eli Lilly | Type 1 diabetes, Type 2 diabetes | Peptides | $69.79 |

| 5 | Farxiga (Dapagliflozin) | AstraZeneca | Type 2 diabetes, type 1 diabetes, heart failure | Chemicals | $59.63 |

| 6 | Mounjaro (Tirzepatide) | Eli Lilly | Type 2 diabetes, obesity | Peptides | $51.63 |

| 7 | NovoRapid (Insulin Aspart) | Novo Nordisk | Diabetes | Peptides | $41.77 |

| 8 | Rybelsus (Semaglutide) | Novo Nordisk | Type 2 diabetes | Peptides | $27.25 |

| 9 | Januvia (Sitagliptin) | Merck | Type 2 diabetes | Chemical | $21.89 |

| 10 | Trajenta (Linagliptin/Metformin) | Boehringer Ingelheim | Type 2 diabetes | Chemicals | $18.15 |

Here, we will introduce the top 10 diabetes drugs based on sales trends in 2024 and explore the factors behind their success.

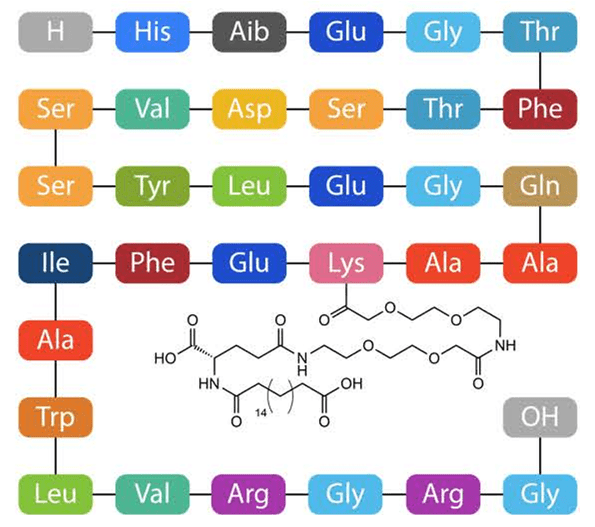

TOP1: Ozempic (Semaglutide)

Sales in 2023: $13.892 billion

Company: Novo Nordisk

FDA first batch date: December 5, 2017

Indications: Type 2 diabetes, cardiovascular risk

Figure 1. Ozempic structure

Why it’s a bestseller: Ozempic’s popularity has surged, cementing it as the world’s best-selling diabetes drug and set to become the world’s best-selling drug, with sales up 66% year-over-year. Demand for glucagon-like peptide-1 (GLP-1) receptor agonists continues to grow, driven by widespread interest in Ozempic, which is approved for the treatment of type 2 diabetes but has a significant weight loss side effect that makes it a trendy weight loss solution.

Since 2022, Novo Nordisk has faced drug shortages due to huge demand and supply chain constraints. The company is still dealing with restrictions on semaglutide-based products, including Wegovy for obesity.

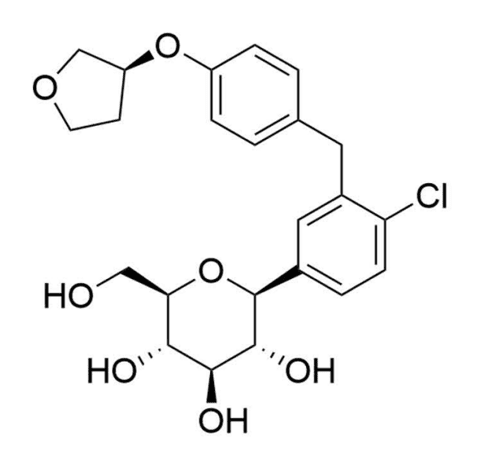

TOP2: Jardiance (Empagliflozin)

Sales in 2023: $10.73 billion

Company: Boehringer Ingelheim/Eli Lilly

FDA first batch date: August 1, 2014

Indications: Type 2 diabetes, chronic heart failure, chronic kidney disease

Figure 2. Jardiance structure

Bestseller reason: In 2023, Jardiance accounted for 28.8% of Boehringer Ingelheim’s net sales, becoming the best-performing product, with sales of the drug up 26.6% from $6.143 billion in 2022. Last year, Eli Lilly’s Jardiance sales were $2.745 billion, ranking fifth in the company’s sales, up 33% year-on-year. According to Boehringer Ingelheim’s 2023 annual report, the drug’s strong performance was attributed to continued strong momentum in indication growth, with European and U.S. regulators approving chronic kidney disease and for the treatment of type 2 diabetes in children. Eli Lilly also attributed the strong sales growth to increased domestic demand in the United States, increased global sales, and favorable exchange rates in markets outside the United States.

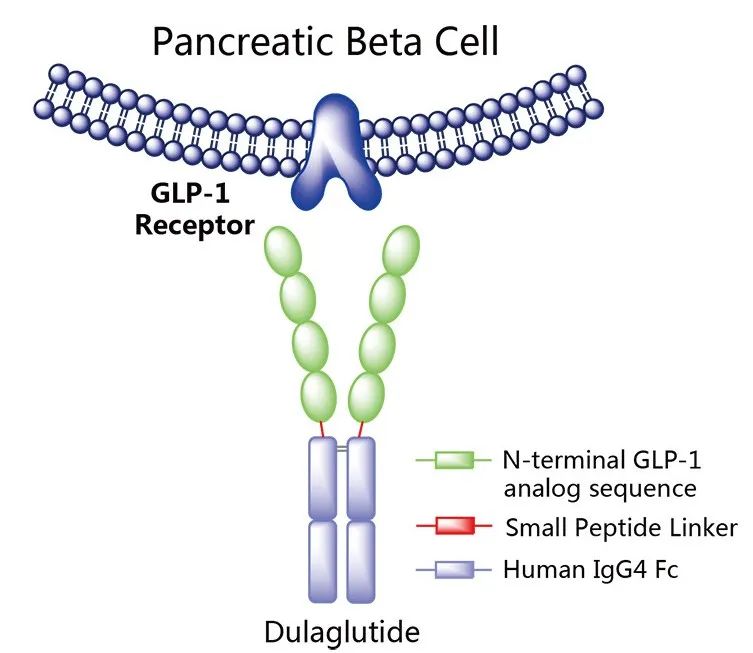

TOP3: Trulicity (Dulaglutide)

Sales in 2023: US$7.132 billion

Company: Eli Lilly

FDA first batch date: September 18, 2014

Indications: Type 2 diabetes

Figure 3. Schematic diagram of Trulicity’s mechanism of action

Bestseller reason: Trulicity is a GLP-1 receptor agonist that enhances the secretion of glucose-dependent insulin and plays a key role in controlling blood sugar levels in adults with type 2 diabetes, more than 95% of whom suffer from type 2 diabetes. Trulicity’s total sales in 2023 reached $7.132 billion. In addition, Trulicity’s established efficacy in reducing cardiovascular risk and the availability of higher doses continue to drive its strong market share.

In Q4 2023, Eli Lilly’s total sales increased by 28% to $9.35 billion, driven by strong performance of new products and existing drugs. The company aims to achieve revenue of $40.4 billion to $41.6 billion by 2024 to achieve sustained growth.

TOP4: Insulin (Various Forms)

Sales in 2023: US$6.979 billion

Company: Eli Lilly

FDA first batch date: November 1982

Indications: Type 1 diabetes, Type 2 diabetes

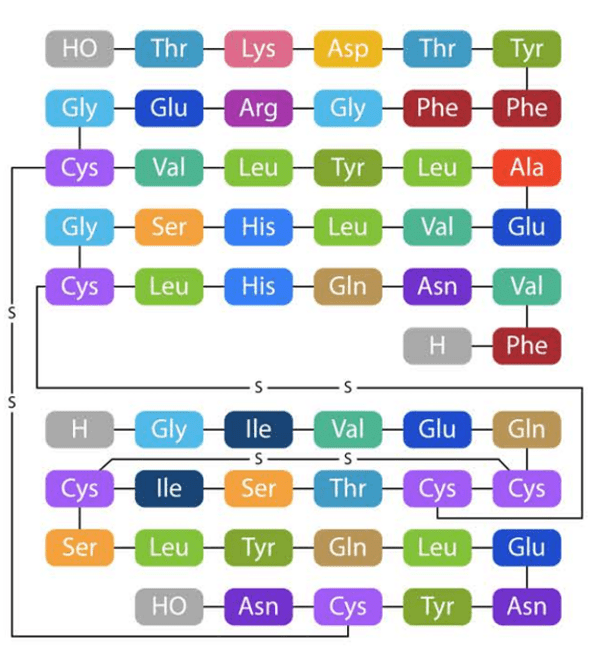

Figure 4. Insulin structure

Best-selling reason: Insulin is an important treatment for survival in patients with type 1 diabetes and is also crucial for controlling blood sugar levels in many patients with type 2 diabetes, making it the cornerstone of diabetes care. The global insulin market is expected to grow from $19.69 billion in 2024 to $25.08 billion in 2032, driven by rising diabetes prevalence, increasing sedentary lifestyles, and advances in insulin products.

Major players in the global insulin market include Eli Lilly, Novo Nordisk, and Sanofi, as well as emerging competitors such as Beacon and Boehringer Ingelheim. These companies are focusing on expanding into new markets, improving affordability, and developing next-generation diabetes management solutions.

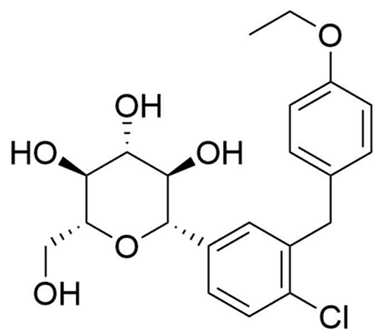

TOP5: Farxiga (Dapagliflozin)

Sales in 2023: US$5.963 billion

Company: AstraZeneca

FDA first batch date: January 13, 2014

Indications: Type 2 diabetes, type 1 diabetes, heart failure

Figure 5. Farxiga structure

Why it’s a bestseller: Farxiga is a novel sodium-glucose co-transporter 2 (SGLT2) inhibitor that is taken orally once daily. As more research highlights the interconnected functions of the heart, kidneys and pancreas, research on this drug continues to expand, investigating its potential for prevention and organ protection. Farxiga’s sales have increased significantly after it was approved for the treatment of heart failure and kidney disease. For nearly a decade, it has demonstrated its effectiveness as a single therapy and as part of combination therapy, along with diet and exercise to improve glycemic control in adults with type 2 diabetes.

TOP6: Mounjaro (Tirzepatide)

Sales in 2023: US$5.163 billion

Company: Eli Lilly

FDA first batch date: May 13, 2022

Indications: Type 2 diabetes, obesity

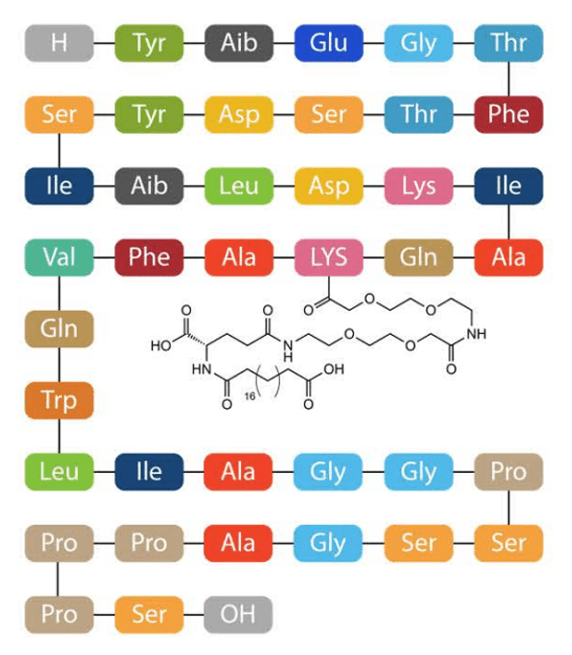

Figure 6. Mounjaro structure

Best-selling reason: Tizepatide is the first dual-acting glucose-dependent insulinogenic polypeptide (GIP) and GLP-1 receptor agonist approved for the treatment of type 2 diabetes. It targets the GIP receptor, complements the effects of GLP-1, and improves insulin regulation and blood sugar control. In November 2023, the FDA also approved tizepatide (Zepbound) for chronic weight management in adult obese patients.

TOP7: NovoRapid (Insulin Aspart)

2023 sales: $4.177 billion

Company: Novo Nordisk

FDA first batch date: September 7, 1999

Indications: Diabetes

Figure 7. NovoRapid structure

Best-selling reason: NovoRapid is a rapid-acting insulin artificially manufactured using modern DNA recombination technology. It can be used alone or in combination with other intermediate-acting or long-acting insulins to control diabetes in adults and children, so that patients can achieve a stable blood sugar target.

The structure and drug action of NovoRapid are similar to the insulin naturally released by the human body, and even faster than human insulin, so it can achieve the effect of controlling blood sugar. When NovoRapid is injected, the drug will begin to work within 10 to 20 minutes, and may reach the highest concentration within 40 to 50 minutes. The drug lasts for about 3-5 hours.

NovoRapid was launched in Europe in 1999 and is currently sold in more than 120 countries around the world.

TOP8: Rybelsus (Semaglutide)

Sales in 2023: US$2.725 billion

Company: Novo Nordisk

FDA first batch date: September 20, 2019

Indications: Type 2 diabetes

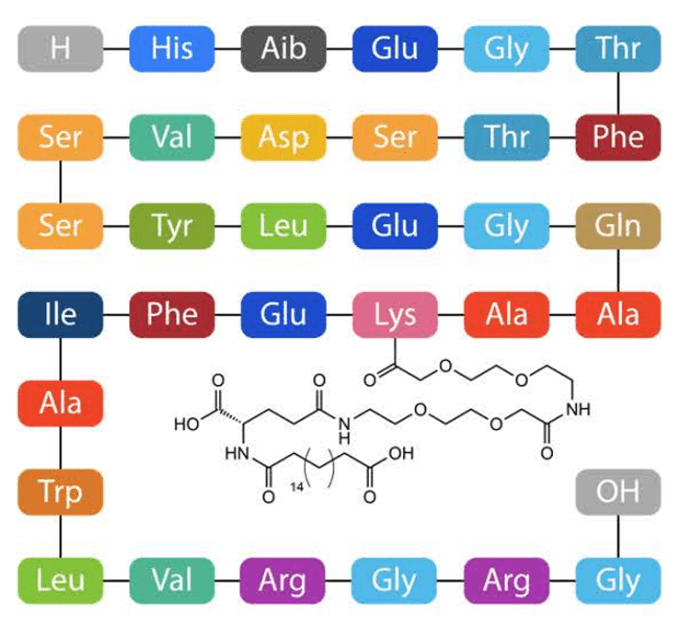

Figure 8. Rybelsus structure

Why it’s a bestseller: Rybelsus sales experienced significant growth in 2022, with sales in Danish kroner (DKK) soaring 134% to DKK 11.299 billion (about $1.6 billion). This strong momentum continued into 2023, with Rybelsus sales increasing 66% in DKK to DKK 18.75 billion (about $2.7 billion).

TOP9: Januvia (Sitagliptin)

Sales in 2023: $2.189 billion

Company: Merck

FDA first batch date: October 17, 2006

Indications: Type 2 diabetes

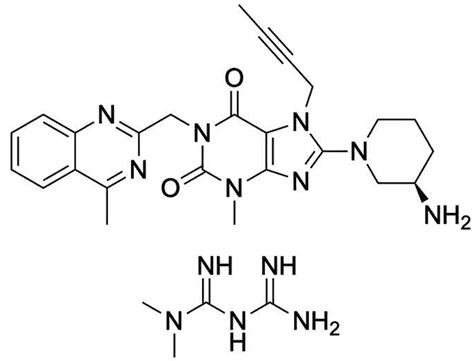

Figure 9. Januvia structure

Bestseller reason: In 2023, Januvia sales reached $2.189 billion. FDA approval is based on the combined results of two double-blind, placebo-controlled monotherapy studies and two double-blind, placebo-controlled combination therapy studies. Compared with placebo, a daily dose of 100 mg of Januvia treatment showed significant improvements in glycated hemoglobin (HbA1c), fasting blood glucose (FPG), and 2-hour postprandial blood glucose (PPG).

TOP10: Trajenta (Linagliptin/Metformin)

2023 sales: $1.815 billion

Company: Boehringer Ingelheim

FDA first batch date: May 2, 2011

Indications: Type 2 diabetes

Figure 10. Trajenta structure

Reason for popularity: Sales of Trajenta have remained stable since Boehringer Ingelheim acquired all rights to Trajenta from Eli Lilly in 2019. The efficacy of Trajenta has been demonstrated in clinical trials, and it can significantly reduce glycated hemoglobin both as a monotherapy and as an add-on therapy. In a randomized, parallel-group Phase III study comparing Trajenta and placebo, Trajenta treatment reduced placebo-corrected glycated hemoglobin (HbA1c) by -0.69% from baseline at 24 weeks (p < 0.0001). Patients receiving linagliptin were also more likely to achieve a ≥0.5% reduction in HbA1c at 24 weeks compared with patients receiving placebo.